Unlock Your Credit Potential with Bossmaker Tradelines

Secure. Transparent. Trusted. – Boost your credit score quickly with 100% Guaranteed-to-Post tradelines, verified by real-time monitoring

- How It Works -

How Bossmaker Provides Tradelines

Step 1

Choose Your Tradeline

Select from our verified AU tradelines.

Step 2

Secure Checkout

Escrow-protected purchase

Step 3

Added as Authorized User

Placement within 1–3 business days.

Step 4

Credit Bureau Reporting

Posts 5–10 days after statement.

Step 5

Verify with Monitoring

Use Reports.Bossmaker.biz to confirm posting in real time

Tradelines = Credit Leverage

Boost Scores Quickly

Fast credit growth from seasoned accounts.

Lower Utilization

High-limit accounts reduce your debt ratio.

Build Age & Depth

Strengthens trust with lenders.

Prepare for Major Purchases

Mortgages, auto loans, business credit.

No Added Debt

Gain history without new balances.

Proof via Monitoring

Know the exact day it posts.

Shop Authorized User Tradelines

Every listing we provide is verified for age, credit limit, utilization, and bureau reporting.

Proof in Your Hands – Monitor Every Move

Every tradeline we provide is guaranteed to post. But don’t just take our word for it — track it yourself. With Reports.Bossmaker.biz, you’ll see updates from all three credit bureaus in real time.

Feature Bullets:

3-Bureau Credit Reports

Instant Alerts When Tradelines Post

Track Score Growth Over Time

Secure Online Dashboard

Primary & Business Tradelines

Primary Tradelines

Build long-term credibility with accounts in your name (StellarFI, Boom Pay, Credit Strong, Self, and more).

Business Tradelines

Establish fundable business credit with no personal guarantee (Uline, Quill, NAV, Crown Office Supply, etc.).

Your $5,000 Head Start

As a Bossmaker client, you’re automatically pre-approved for a free $5,000 primary tradeline. No credit pull. No hassle. Just goodwill from us to you.

- About Us -

Introduction: Bossmaker Tradelines

Welcome to Bossmaker Tradelines, where we specialize in unlocking new financial possibilities for individuals seeking to enhance their credit profiles. At the core of our service, we offer authorized user tradelines, a powerful tool designed to help you improve your credit score quickly and effectively. Our mission is to empower you with the resources you need to achieve greater financial stability and access to better credit opportunities.

Bossmaker Tradelines stands committed to providing strategic solutions that are both accessible and transformative. By incorporating seasoned tradelines into your credit history, we assist in elevating your credit score, thereby broadening your financing options and enhancing your borrowing power. Whether you are preparing for a major purchase, seeking to lower interest rates, or aiming to secure substantial loans, Bossmaker Tradelines is here to guide you towards achieving your financial goals with confidence and clarity.

Testimonials

- FAQ's -

Frequently Asked Questions

What is guaranteed?

Bossmaker Tradelines offers 100% Guaranteed to Post tradelines. This guarantee is backed by reliability, transparency, and real results. It provides confidence and clarity, ensuring tradelines post reliably and on time, every time, with "no guessing, no waiting".

What happens if a tradeline doesn’t post?

The guarantee ensures the tradeline will post. In the rare cases of early removal by the primary cardholder, Bossmaker Tradelines offers protection by guaranteeing minimum posting windows and providing reassignments when necessary. Maintaining your access to the authorized user tradeline is a priority throughout your purchase.

How long do tradelines stay on my report?

Most tradelines report for 30 to 60 days. Some agreements may last up to 90 days. Your personalized dashboard displays your specific timeline, including the statement date and expected removal period.

Do you provide Primary or Business Tradelines?

Yes, Bossmaker Tradelines offers solutions designed to help you build or strengthen your credit profile through both primary (personal) and business tradeline additions.

Specialization:

We currently specialize in personal Authorized User (AU) tradelines. However, we are actively expanding into business credit solutions and invite users to contact us to request updates or pilot access to these future offerings.

Primary Tradelines (Recommendations):

Bossmaker Tradelines recommends specific primary tradelines that help build deeper financial credibility over time. Recommended primary tradelines include StellarFI, Kick Off, and Self. A general qualifying factor for clients seeking primary tradelines is having at least one $5k tradeline reporting to the credit reporting agencies.

Business Tradelines (Recommendations):

We also recommend specific business tradelines, such as Uline, Grainger Industrial Supply, and Quill. These accounts report to business bureaus (like D&B, Experian, and Equifax), making your business file look credible to lenders. All recommended business tradelines require No Personal Guarantee (No PG).

How do I confirm my tradeline has posted?

The sources state that once a tradeline is purchased, you can track your orders and receive updates every step of the way via your dashboard. The specific URL "Reports.Bossmaker.biz" is not mentioned in the provided source material.

What payment methods are accepted?

Payment is made securely with your credit card through their trusted third-party escrow services. The use of escrow ensures a hassle-free and protected transaction, where payment is only released after receiving the service and confirming the agreed-upon terms are met.

What are verification requirements?

The platform verifies all primary cardholders. For buyers, the trusted third-party escrow provider verifies all clients. Furthermore, for an authorized user (AU) purchase, the AU must match required identity verification. Clients must review eligibility criteria regarding report structure, address stability, and identity verification standards. For recommended Primary and Business Tradelines, a general qualifying factor is having at least one 5k tradeline already reporting to the credit reporting agencies.

Contact Us:

Email: [email protected]

Phone : (800) 987-0288

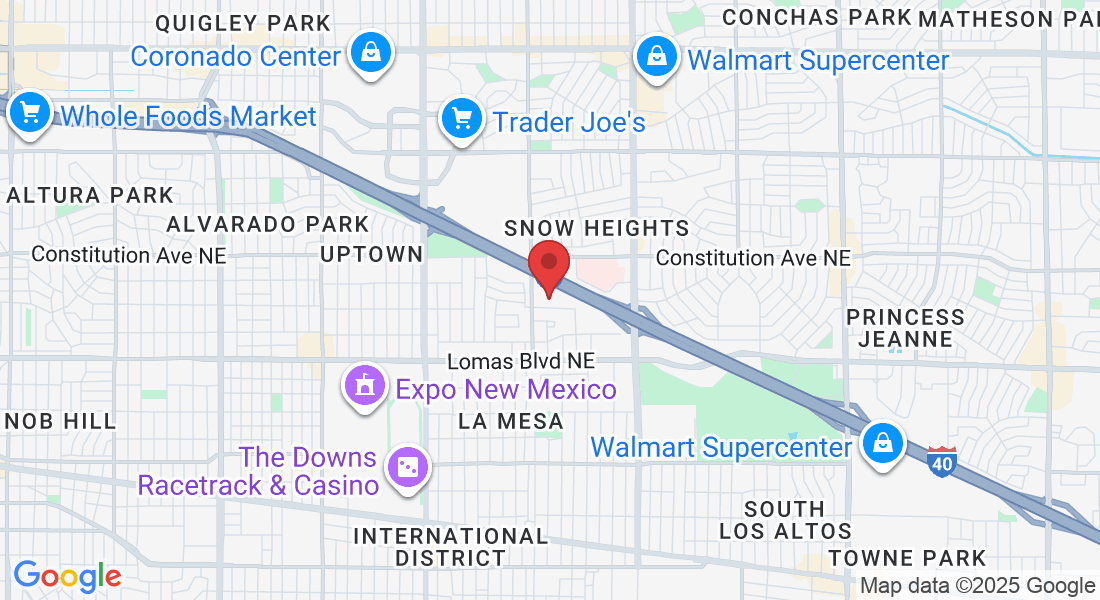

Address: 1209 Mountain Road PL NE Ste. 7398 Albuquerque, NM, 87110, USA

Copyright © 2025 Bossmaker. All Rights Reserved